Summary

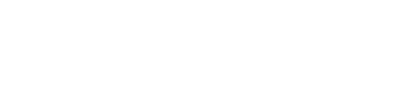

California retail cannabis sales (and total U.S.) are, in the aggregate, ~$6 billion less than what many industry observers, analysts (including us), and news media have reported (2018-2022). Our analysis was triggered by an added level of transparency that commenced in Q1:23 when excise tax reporting shifted from distributor to retailer.

Our methodology and calculations were confirmed by a representative of the California Department of Tax and Fee Administration.

Background

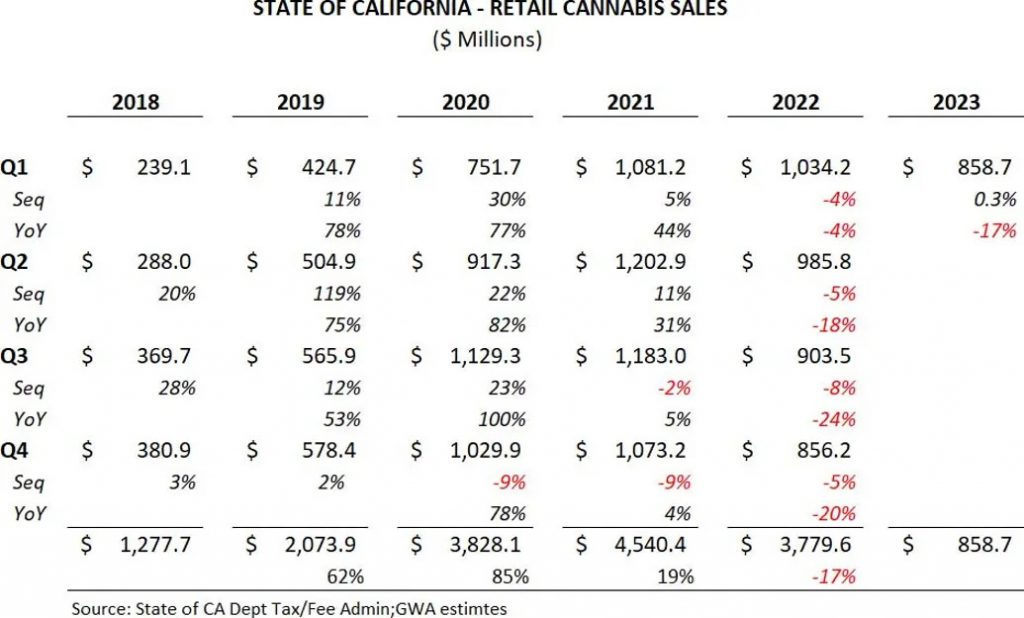

In the past, the state disclosed ‘taxable sales’ which was widely interpreted as “cannabis sales’. The former includes the sale of ancillary products sold at retail (i.e. pipes and other merch) as well as total cannabis sales including the 15% excise tax. (e.g. cannabis sales of $100 equates to $115 in “taxable sales”).

The split between “cannabis sales” and “taxable sales” is now readily apparent (as of Q1:23) per the state data portal:

Cannabis Sales – Cannabis sales represent amounts reported by retailers subject to the excise tax.

Taxable Sales – Taxable sales include sales of cannabis, cannabis products, and other retail sales of tangible personal property reported on sales and use tax returns.

| Also Read Mastercard Demands US Cannabis Shops Stop Accepting Debit Cards |

However, to provide investors and other stakeholders with a more accurate depiction of historical sales trends we did the simple math by dividing reported excise taxes (per data portal) by the state-imposed 15% excise tax rate. Revised cannabis sales trends are illustrated below.

For those that have interpreted “taxable sales” as “cannabis sales”, the following chart illustrates the difference by year for California as well as the impact to total U.S cannabis sales..

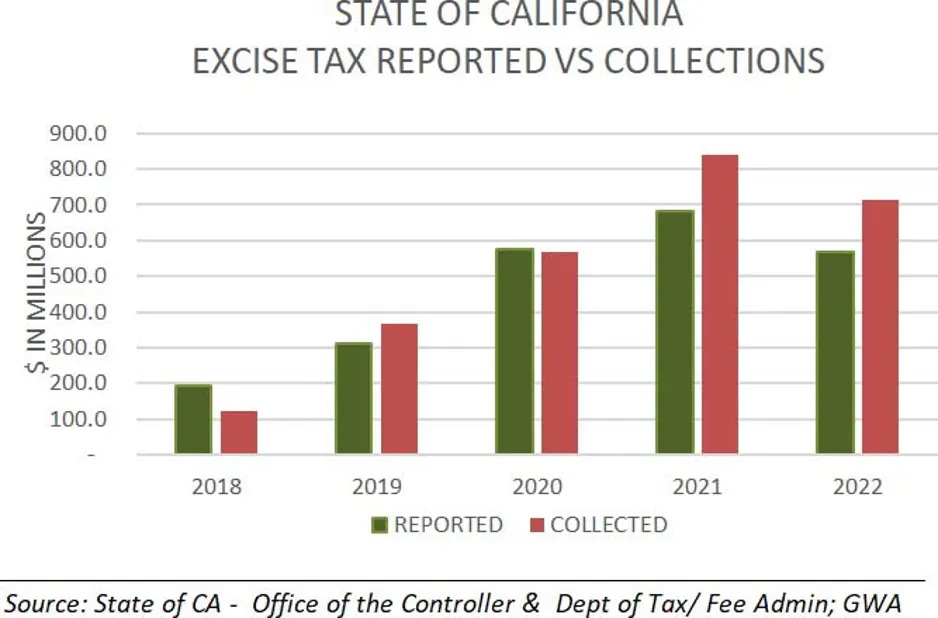

Taking this a step further, we compared the excise tax reported in each period (aggregate of the excise taxes reported on the state’s cannabis data portal) to the total amount remitted to the taxing authorities (line item on the state’s financial statements). To better understand, think of this as the tax due on a personal tax return vs the amount actually paid to the IRS. In theory, both should be equal but due to timing differences, there are discrepancies from period to period.